401k deduction calculator

This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K.

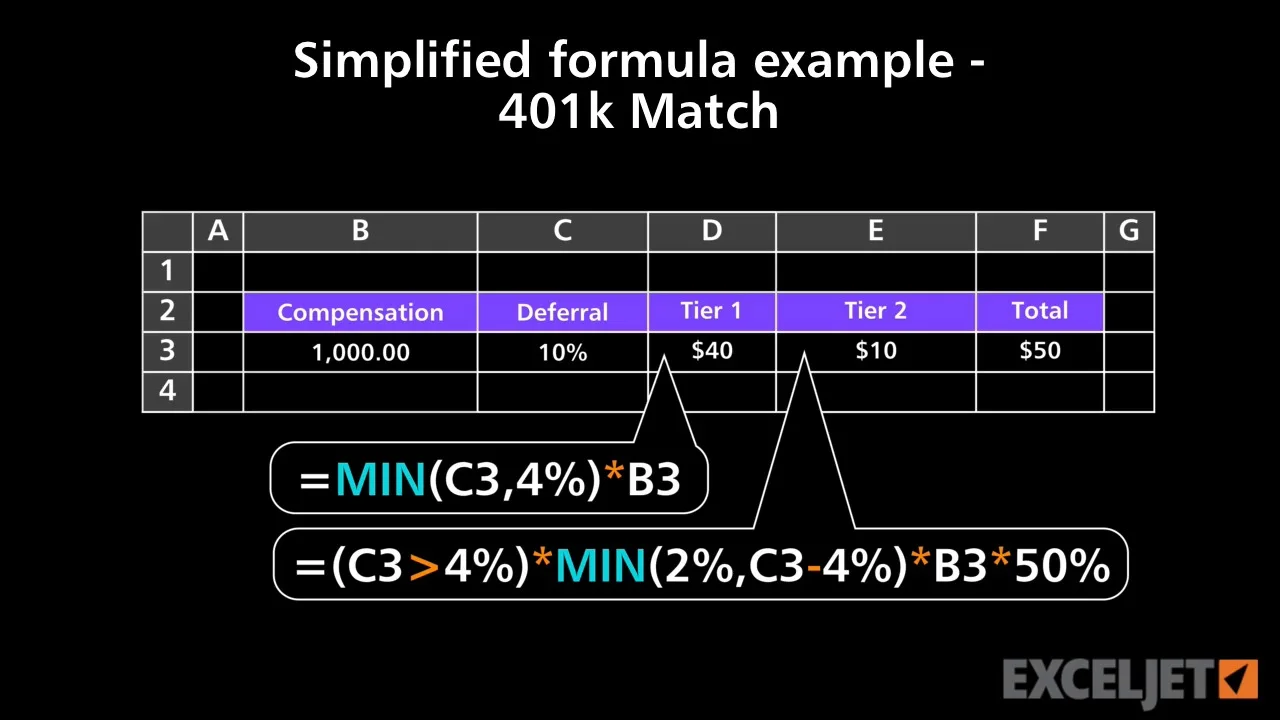

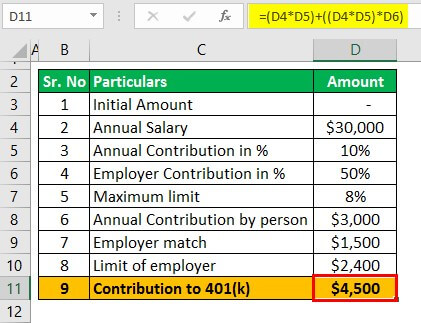

Excel Tutorial Simplified Formula Example 401k Match

How much should you contribute to your 401k.

. Anything your company contributes is on top of that limit. Ad Strong Retirement Benefits Help You Attract Retain Talent. Visit The Official Edward Jones Site.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. How does a Roth IRA work. Retirement Calculators and tools.

Your 401 k contributions directly reduce your taxable income at the time you make them because theyre typically made with pre-tax dollars. Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. How to pick 401k investments.

It provides you with two important advantages. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. NerdWallets 401 k retirement calculator estimates what your 401 k.

Compare 2022s Best Gold IRAs from Top Providers. First all contributions and earnings to your 401 k are tax deferred. A 401 k can be one of your best tools for creating a secure retirement.

Those who are 50 years or older can invest 6500 more or 27000. Learn How We Can Help Design 401k Plans For Your Employees. Reviews Trusted by Over 45000000.

In 2022 you can contribute 20500 to a 401 k. When you make a pre-tax contribution to your. Ad TIAA IRAs Give You The Flexibility And Convenience You May Need In Retirement.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. To get the most out of this 401k calculator we recommend that you input data that reflects your retirement goals and current financial situation. New Look At Your Financial Strategy.

Ad Get Help Rolling Over Your Old 401k Account to a Fidelity IRA. How 401 k Deductions Work. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. 401 k Distribution Calculator.

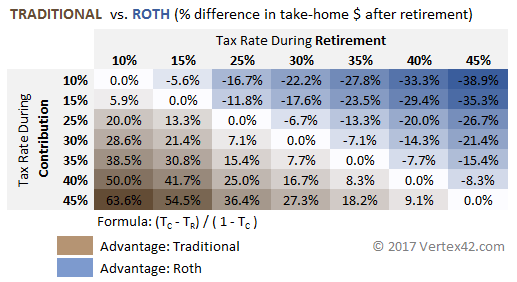

Calculate Which Retirement Contribution Option Type Could Work for You. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Step 2 Figure out the rate of interest that would be earned. Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Ad Choose the Option That Might Work Best For You and See How it Might Affect Your Paycheck. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. An employer may match up to 3 of.

Traditional 401k Retirement calculators. Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Also a fixed periodical amount will be invested in the 401 k Contribution which would be a maximum of 19000 per year. Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account.

401k Roth 401k vs. Our free 401 k Distribution Calculator helps you to determine your withdrawal amount and where you stand with your 401k or IRA account.

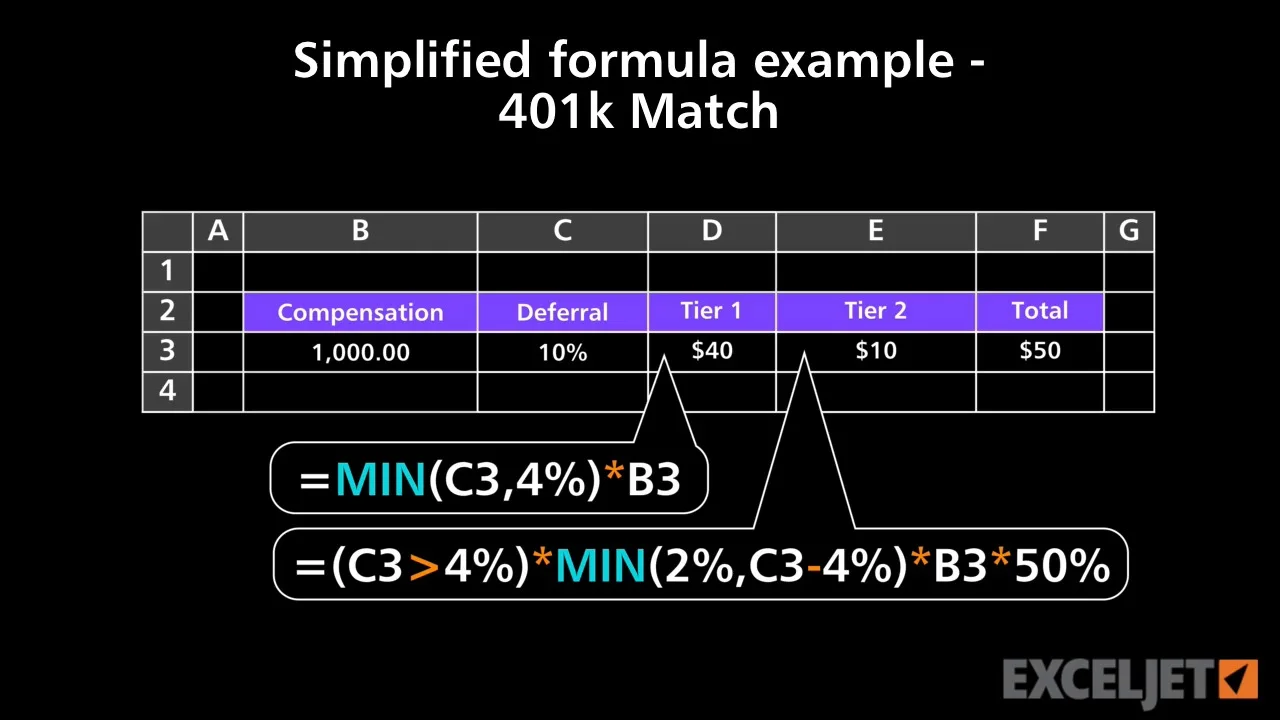

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Solo 401k Contribution Limits And Types

:max_bytes(150000):strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

How Much Can I Contribute To My Self Employed 401k Plan

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

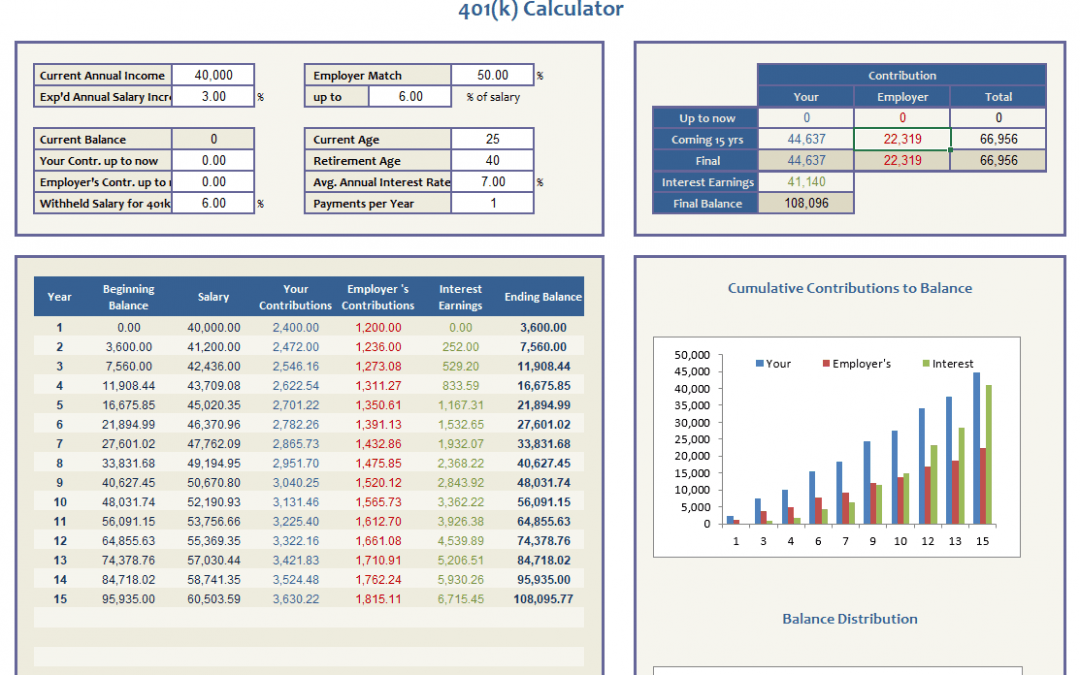

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

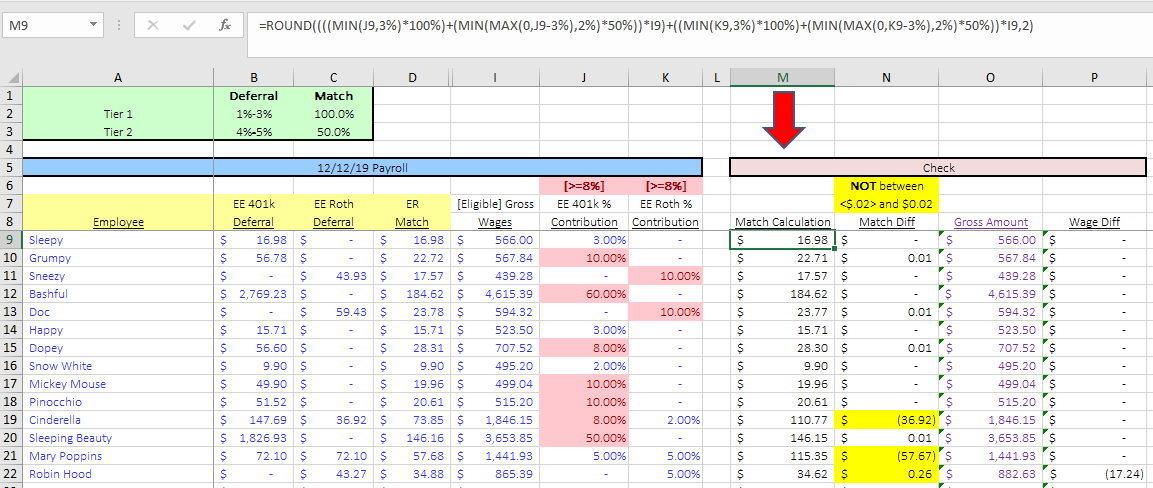

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

Customizable 401k Calculator And Retirement Analysis Template

Microsoft Apps

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401k Contribution Calculator Step By Step Guide With Examples

401k Calculator

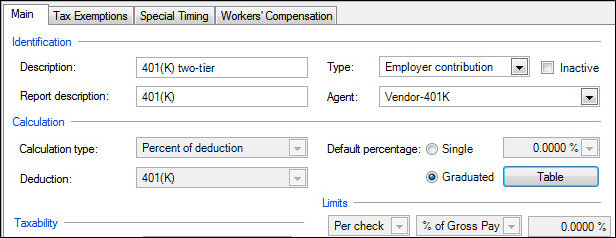

Employer Contributions Setup Examples Including A Graduated Table Example

Traditional Vs Roth Ira Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings